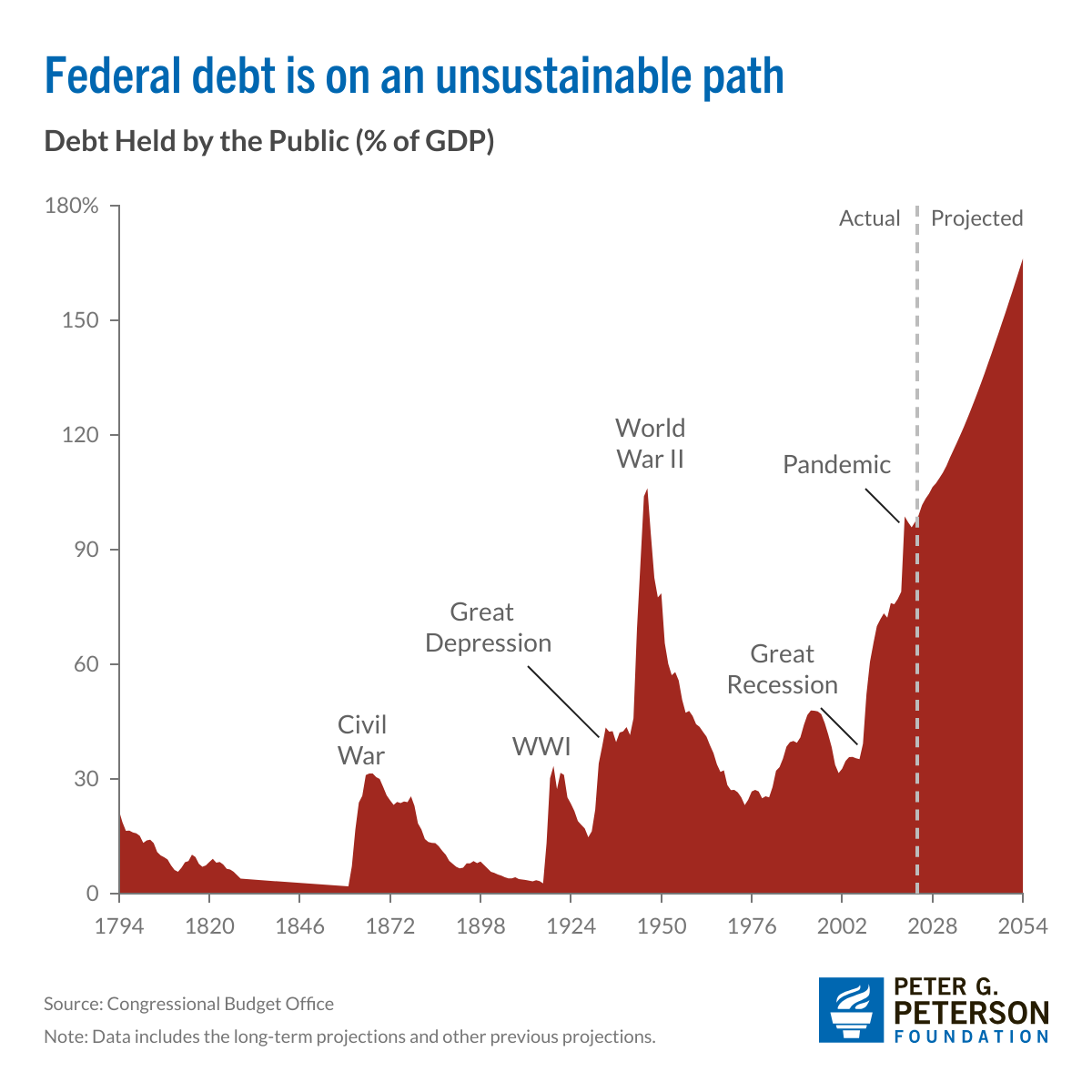

America stands on the edge of a financial disaster that could overshadow the Great Depression. As of March 2025, our federal debt—the amount owed to banks, investors, and foreign governments, not just internal obligations—reaches nearly $29 trillion, according to projections from the Congressional Budget Office (CBO). This exceeds 100 percent of our Gross Domestic Product (GDP), the total annual value of our goods and services. Imagine borrowing more than your yearly income, then taking on additional debt just to pay the interest—that’s our reality. The CBO forecasts this debt could rise to 116 percent of GDP by 2034 without intervention. Analysts at the Penn Wharton Budget Model warn that such unsustainable levels could destabilize our economy over the coming decades. Failure to act risks default, leaving creditors unpaid, or rampant inflation that erodes your savings to nothing. Yet, amid this looming crisis, Washington continues sending billions in foreign aid to nations like Ukraine, Israel, and Egypt—funds many conservatives argue should bolster our own faltering foundation.

A Warning Ignored

Rewind to 2012: the “fiscal cliff.” Tax cuts worth about $600 billion were set to expire, new taxes loomed, and $900 billion in automatic spending cuts threatened to slash defense and domestic programs. The CBO warned that without a resolution, unemployment could reach 9.1 percent, and GDP might contract by 0.5 percent in 2013—a shock that would idle factories and eliminate jobs. Congress patched together a last-minute deal, but the underlying problem—our borrowing addiction—remained untouched. Today, the Treasury reports our primary deficit (spending minus revenue, excluding interest) at 3.3 percent of GDP for 2024, with costs set to climb as Baby Boomers draw on Social Security and Medicare. In 2024, we collected 17.5 percent of GDP in revenue but spent 20.8 percent, a gap the CBO predicts will grow, with spending reaching 24.1 percent of GDP by 2054. This shortfall fuels the debt monster, driving us nearer to collapse.

The Clock Is Ticking

The Penn Wharton Budget Model cautions that our debt path could undermine economic stability over the coming decades. Japan manages higher debt because its citizens save aggressively; Americans do not. To stabilize, the CBO estimates we’d need to cut spending or raise taxes by 4.4 percent of GDP annually—about $1.2 trillion today—for decades. Postpone this, and rising interest rates could choke businesses and stall growth as lenders hesitate. Markets could unravel via backward induction: if investors doubt our ability to repay, they’ll stop lending, sparking widespread panic. The result could be default or hyperinflation, where everyday purchases demand piles of devalued dollars.

Billions Abroad, Pain at Home

Here’s the sting: while Americans struggle, the U.S. disbursed $63.7 billion in foreign aid in fiscal year 2023. This includes $16.6 billion to Ukraine for its ongoing conflict with Russia, $3.3 billion to Israel for systems like the Iron Dome, and $1.4 billion to Egypt for regional stability. Ukraine’s aid sustains a far-off war with no clear resolution, Israel—a thriving ally—receives a $38 billion, 10-year package signed in 2016, and Egypt’s funds support a fragile peace. Strategic merits aside, conservatives assert that $63.7 billion could repair our roads, strengthen our military, or reduce our debt. In 2012, the Tax Policy Center estimated that letting tax cuts lapse could have cost families $3,500 each. Now, with the CBO highlighting debt as an economic burden, every dollar sent overseas deepens the strain on taxpayers already stretched thin.

A Budget Killer

Foreign aid isn’t merely lavish—it’s a fiscal spark. The Penn Wharton Budget Model shows debt crowding out private investment, reducing jobs and wages while weakening the tax base needed for recovery. The Peter G. Peterson Foundation lists 76 options—adjusting Social Security, taxing carbon, streamlining healthcare—to save trillions. Yet aid to Ukraine, Israel, and Egypt flows through discretionary spending, which Congress could curb, while the Treasury warns that procrastination deepens the hole. By 2034, the CBO projects interest payments could reach 3.9 percent of GDP—surpassing spending on education or infrastructure. With debt mounting, a single crisis could leave us desperate for rescue.

America First, Now

Conservatives champion a core principle: don’t spend beyond your means, and put your own house first. The 2012 fiscal cliff was a siren; today’s debt crisis is the full alarm. Sending billions to Ukraine, Israel, Egypt, and elsewhere isn’t noble—it’s reckless when Americans suffer. We cannot support the globe while our economy quakes. Cut the aid, tighten the belt, and save America before it’s too late.

Leave a comment